Don't Be Fooled by Discounts

I Pity the Fool!

The holidays are approaching, and you know what that means - shopping! Even though you have survived Black Friday and Cyber Monday, the flashy sales persist. It seems that hardly anything is full price at this time of year.

While those plummeting prices plead for our attention, it's important to maintain self control and make and stick to a budget. We've all been there - we walk out of the store as a proud new owner of a whatchamacallit that we got a steal of a deal on already asking ourselves why we bought it. In a year or two (or maybe even less), you'll probably be calling that whatchamacallit just that, because you've forgotten all about it and never got much use from it.

The Golden Rule of Shopping Smart

Would I buy it if it wasn't on sale? If the answer to this question is no, you are not saving money.

Even if that awesome shiny new gadget is 99% off, if you have no need for it and would never have thought to buy it if the sale never happened, you have been fooled by the seller.

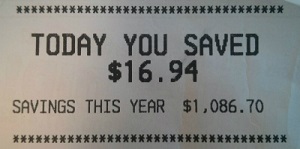

It's common practice for stores to print on receipts how much you "saved" by buying things at a discounted price. The chances that you would have bought all those discounted items had they not been on sale are small. Of course, I'm not saying that you shouldn't look for a deal when you're planning on buying something.

People go to school to learn how to coax deal hungry shoppers to buy extra stuff. Don't play into their hands.

Other Questions to Ask Yourself Before Handing Over the Plastic

I'm a big Jerry Seinfeld fan. I've seen every episode of Seinfeld, and also enjoy his stand up. In one of his stand up routines, he does a bit about ordering something from one of those home shopping TV stations. As part of that bit, he says the following: "There is no more embarrassing thing in my life that the fact that I have actually uttered the phrase, 'I would like to order the Ginsu Knife.'"

I've listed some questions below you may want to ask yourself before you make an unplanned purchase that could help you avoid such buyer's remorse:

- Can you imagine yourself ever using it? How much use do you believe you'll get out of it? If you buy that fancy Japanese knife, can you imagine yourself in your kitchen actually using it? What about all those other knives that you've gotten along just fine with all this time?

- Do you see yourself using it in a year? Everything changes with time, and our feelings about our impulse purchases are certainly no exception. Is it going to be one of those items that you use religiously for a week and then never think of it again?

- Can you imagine yourself telling someone you bought the item? When your friends and family see you wearing that new smartwatch, will you be proud to tell them about it, or will you be embarrassed you paid anything for it?

- How often will you use it? You might be satisfied with your purchase, but does the frequency you will use it justify the price? Maybe that fancy leaf blower with red and orange flames won't seem as enticing if you think about how you'll only use it twice a year.

- Is this actually a quality product? Many items that are on sale at this time of year are things that stores couldn't get off their shelves and are probably just desperate to recover their costs. This article on ZDNet points out this phenomenon with tablets. With sites like Amazon and Google Shopping with millions of reviews on almost every product out there, there's really no excuse to not shop around anymore.

The Smarter (Less Exciting) Alternative

Here's an idea: rather than waste your precious mula on that thing-a-ma-jig, why not put that money to work in a savings account? If you're feeling more adventurous, there are other financial vehicles like CDs, Money Markets, or even Bonds. You won't get the same adrenaline rush that comes from whipping out your credit card to purchase that coveted gizmo on clearance, but you will be putting your money to work for you.

I've recently put a chunk of my savings into an Ally Savings Account using the Ally website due to their competitive interest rates and some favorable reviews I've heard from friends and read online. I've been pleased with their service and just saw my first interest posted to my account. At the time of this writing, Ally's APY is 0.85% for an online savings account. While that doesn't seem high, you will be making money for doing absolutely nothing besides resisting the urge to meddle with it.

Personal Experiences with Staying Disciplined During the Big Sales

I never went Black Friday shopping until I met my wife. She has 4 sisters, and it's a Thanksgiving tradition to shop literally all night after the big feast. I've been shocked to witness the apocolyptic feel of Black Friday. I personally feel that it's one giant step backwards in the progress of civilization.

However, I truly admire my wife's mindset as we begin our all night shopping excursion. She will always tell me the things she needs and where she plans on buying them based on research she's done. Her purchases are almost always reasonable, logical, and at an amazingly low price. This year her big purchase was an iPad mini at Walmart, which came with a $100 store gift card. She was planning on buying one anyway for the grand prize of a fitness competition she is hosting, so getting the gift card was icing on the cake.

On a related note, I recently signed up for a cash back rewards card. I tried to do my research beforehand to pick one with no annual fees and competitive rewards. I also committed myself to never carry a balance by paying off my monthly statement in full when it was due. So far, I've been successful and have earned rewards on things I would have bought anyway. The questions I've had to ask myself, however, is how many purchases do I make that I otherwise wouldn't now that I'm always getting a discount, albeit relatively small?

Since signing up for this card, which features bonus rewards categories that change regularly throughout the year, I've had to pay special attention to my buying habits. There seems to be an all out assault to get me to swipe that thing anytime and anywhere I get the chance. Those bonus rewards categories and initial sign up bonuses for other cards make me feel like I'm chasing a carrot that's hanging from a stick attached to my forehead.

The rush of cashing in on different deals can sometimes be overwhelming. However, stopping and asking myself the questions I've listed above always seems to bring me back to earth and help me make a logical decision.

The Bottom Line

Next time you find yourself tempted to buy something that you weren't planning on buying in the first place, ask yourself if you would buy it if it wasn't on sale. Chances are that if you answer no, you won't get your money's worth, even considering the discounted price. Hold on to that hard earned cash for something you'll get more use from later.

Bonus Tips

Related Lenses